Inflation is cooling off, but prices are still high—especially for medical care. Medical inflation is far outpacing increased costs for other goods, and that’s having a direct effect on Americans’ health. According to Gallup, about 2 in 5 Americans (38%) delayed medical treatment due to costs in 2022, an increase of 12 percentage points from 2021 and the highest share since 2001. Due to costs, those with serious conditions were more apt to put off care.

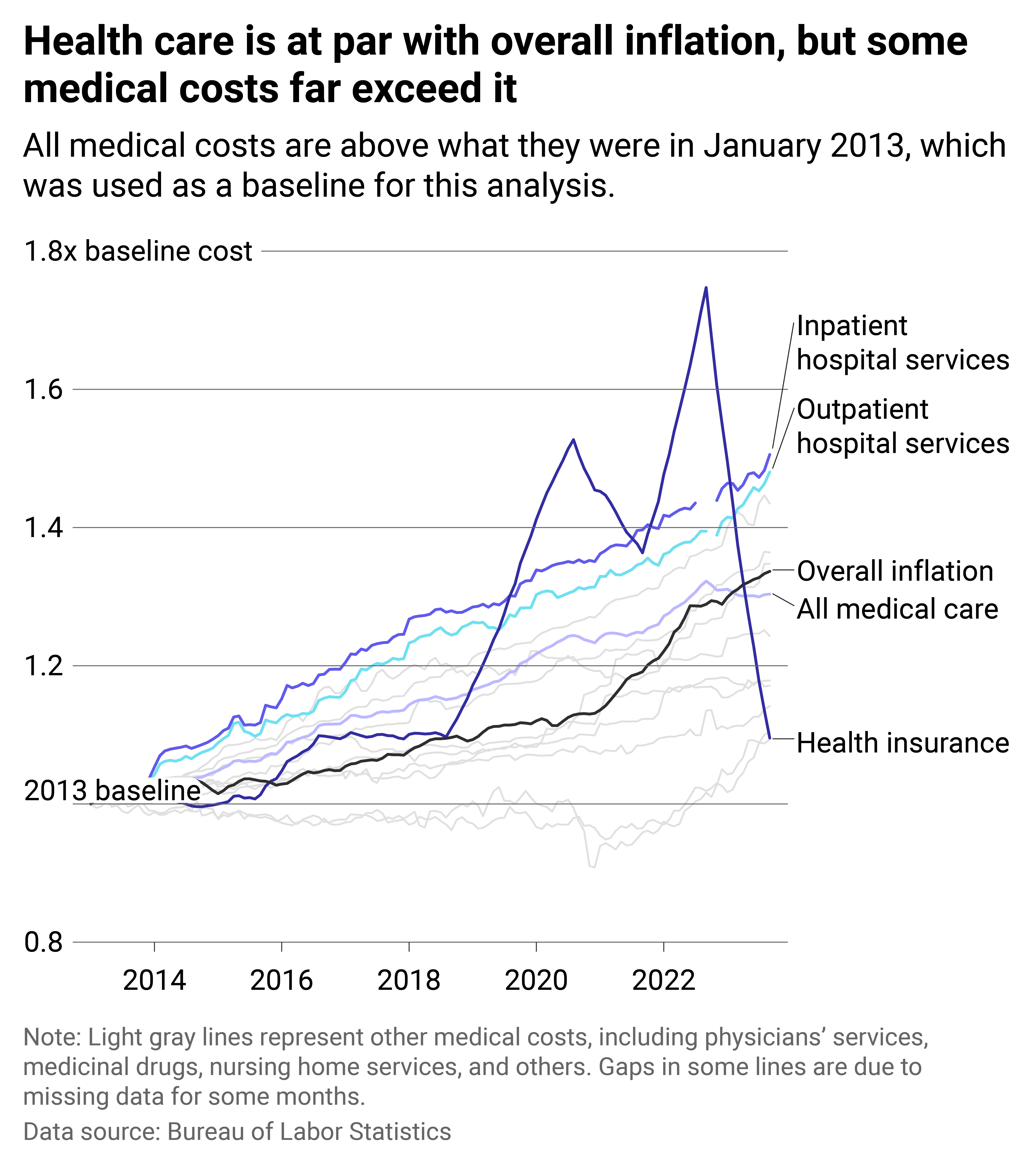

Incredible Health analyzed the increasing costs of medical care and its contributing factors, referencing Bureau of Labor Statistics data.

Rising health care costs are partly due to an aging population. According to the Peter G. Peterson Foundation, 13% of people in the U.S. in 2010 were aged 65 and older; by 2021, 16% were 65 and up. By 2030, 1 in 5 people will be a senior citizen. Comparatively, this age group spends the most on health care, which means overall costs are expected to increase. Other factors also contribute to higher prices, including expensive new technology, more administrative costs, and hospital consolidation.

Americans may be spending more on health care, but they’re not getting the improved health they might think they’re paying for. Compared with other nations, the U.S. spends more money per capita on health care, but Americans continue to have a lower life expectancy and higher rates of obesity, diabetes, and infant mortality.

![]()

Incredible Health

How various health care costs have changed in 10 years

Inflation metrics for health insurance trail other metrics because people register for insurance plans before they get health care. Plan costs are set for the year, so if costs run higher, health insurers must absorb them until they can adjust insurance prices.

Consumers can expect insurance prices to rise more than usual in 2024, as Mercer forecasts a 5.4% premium increase, up from the typical 3% to 4% increase. Additionally, a Peterson-KFF Health System Tracker analysis found that plans available through Affordable Care Act marketplaces will likely have a 6% increase. Other factors to consider include inflation, which has affected the cost of medical supplies, and staffing shortages at hospitals and health care systems, which have prompted higher wages. Not to mention more medical claims and higher prescription drug prices will also increase plan prices.

According to the Kaiser Family Foundation, 3 in 5 adults take at least one prescription drug, and 1 in 4 have four or more prescriptions. Price increases quickly become a pain point, particularly for people who are uninsured.

Pharmaceutical manufacturers make drug price adjustments twice yearly, in January and July, according to the Office of Health Policy in the Office of the Assistant Secretary for Planning and Evaluation for the Department of Health and Human Services. During those months in 2022, manufacturers increased prices more than usual on more drugs. January’s increase affected 3,239 drugs, with an average increase of nearly $150 per drug; in July, 601 drugs had higher prices, with an average of $250 per drug. Ativan, a drug used to treat anxiety, had a 7.9% increase, from $37.65 to $40.62 per pill. Greenstone’s Fluconazole, used to treat fungal infections, jumped nearly 1,101%, from $2 to $28 per pill.

When prices jump, affordability decreases. According to KFF, nearly 2 in 5 of those with four or more prescriptions have trouble paying for them. Three in 10 adults cut medication costs by skipping doses, cutting pills in half, not filling prescriptions, opting for over-the-counter medication, or bypassing their prescription drugs altogether.

Consolidation within the industry has also led to higher prices. Kaiser looked at an analysis of several types of hospital mergers and found that less competition typically led to higher prices for insurers. When hospital consolidation resulted in just one option within a 15-mile radius, prices were 12% higher than in markets with four or more hospitals nearby. In more consolidated markets, private insurers have less power to rein in providers’ prices.

Story editing by Jeff Inglis. Copy editing by Paris Close. Photo selection by Clarese Moller.

This story originally appeared on Incredible Health and was produced and

distributed in partnership with Stacker Studio.